Third Point Files Definitive Proxy Materials for Campbell Soup Company’s 2018 Annual Meeting

Third Point LLC (NYSE: TPRE; LSE: TPOU)("Third Point"), a New York-based investment firm managing approximately $18 billion in assets, holds approximately 6% of the outstanding common shares of Campbell Soup Company (NYSE: CPB) ("Campbell" or the "Company") and has filed a definitive proxy statement with the Securities and Exchange Commission (“SEC”) to replace the entire Board of Directors with its highly qualified nominees (the “Independent Slate”) at Campbell’s 2018 Annual Meeting of Shareholders. Shareholders expect the Company to announce the meeting date shortly.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181001005539/en/

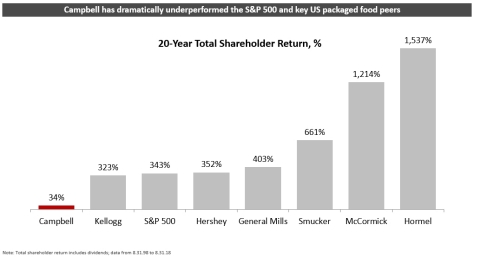

Campbell has dramatically underperformed the S&P 500 and key US packaged food peers (Graphic: Business Wire)

Along with its filing, Third Point has mailed to fellow shareholders a booklet introducing its slate – The Independents – which highlights the outstanding qualifications of its twelve directors and their unique ability to save this deteriorating business. Third Point also released an in-depth presentation which is available at www.RefreshCampbells.com/change. The presentation lays out why, in Third Point’s view, the Company’s current leadership is incapable of turning Campbell around at this critical juncture and how two decades of blunders in leadership, strategy, and execution have destroyed shareholder value.

To introduce its proxy to shareholders, Third Point sent the following letter to its fellow shareholders, urging them to VOTE the WHITE Proxy Card to #RefreshTheRecipe at this year’s Annual Meeting:

***

September 28, 2018

Dear Fellow Campbell Soup Company Shareholder:

We are sending you this letter because you are a fellow owner of Campbell Soup Company (“Campbell” or the “Company”). During this proxy season, you have an opportunity to vote for new, energetic, shareholder-aligned leadership, known as the “Independent Slate”, and replace Campbell’s entrenched Board of Directors (the “Board”) who we believe made a series of strategic mistakes and operational failures that have destroyed the value of your holdings. We want to work with you to help reverse Campbell’s deteriorating performance, regain your lost investment, and put this important American company on a new path of growth, innovation, and profitability.

Today, we are asking for your vote on the White Card for the Independent Slate.

Campbell Shareholders Have Suffered from Poor Performance

Over the past twenty years, shares of Campbell have barely appreciated. $1 invested in Campbell in August 1998 is only worth $1.34 today. That same $1 would be worth $4.43 if you had invested in the S&P 500 or as much as $16.37 if you had invested in one of Campbell’s competitors like Hormel!

Campbell’s Leadership Should be Held Accountable for Failing Shareholders

The dismal stock performance is a report card on the Company’s leadership, which has made a series of blunders. We believe the past year has been particularly disastrous. Campbell’s key brands are rapidly losing market share. Its leadership drastically overpaid for bad deals that saddled the Company with way too much debt. Earnings per share in the most recent quarter were down more than 50%. To make matters worse, the Company has no permanent CEO and is being run temporarily by a Board member who has no food or beverage experience.

The Company has admitted their past actions are to blame. The interim CEO said to shareholders in August:

“Simply put, we lost focus. We lost focus strategically… We lost focus within our products and brands… We lost focus in process and execution… And finally, we didn’t have a culture of accountability, which led to poor execution.”

Seriously? Apparently, the Board was more focused on lavishing its then-fellow Board member and former CEO Denise Morrison with enormous cash and perks as performance deteriorated. From 2011 to 2018, while shareholders and employees suffered, the CEO received more than $60 million in total compensation. To pay so much money for such poor performance suggests the Board either did not understand what was happening to the business or simply did not care. In the midst of the Company’s crisis, the Board authorized this same CEO to hobnob in Davos at the World Economic Forum with the global elite – at shareholders’ expense – rather than stay home and run the ailing Company. Does this sound like a Board who shares your best interests?

Our Goal: Change the Board to Create Long-Term Value for All Shareholders

We take our advice from Albert Einstein, who said that “The definition of insanity is to do the same thing over and over again and expect a different result.” This Board has failed shareholders time and again. At this point, we would have only ourselves to blame if we leave the Board that caused the Company’s woes in charge of fixing them.

Third Point has proposed a slate of directors who brings sophisticated and diverse expertise to set Campbell on a new path. Through the representatives on the Independent Slate, we own more than 8% of the Company and we are aligned with you. The Independent Slate will manage Campbell to enhance long-term value and pursue optimal outcomes for all shareholders.

About Us

Third Point LLC (“Third Point”) is an investment firm managing approximately $18 billion in assets for public institutions and private clients. The firm was founded in 1995 by Daniel S. Loeb, who serves as Chief Executive Officer and oversees our investment activity. Third Point has a long track record of sharing our views and insights to help companies maximize shareholder value, improve corporate governance, and strengthen market positioning. Our executives have served on the Boards of Directors of numerous well-known public companies, including Yahoo!, Sotheby’s, and Baxter International. Our independent nominees have also served on Boards, including DowDuPont.

More Information

For more information, including why we believe the current Board should be replaced and detailed biographies for the Independent Slate, we invite you to visit our dedicated website at www.RefreshCampbells.com. You can also speak with our proxy solicitor, Okapi Partners, if you have questions about the voting process or need help in voting your shares by calling them toll-free at 855-208-8902 or emailing them at [email protected].

It’s Up to You

Regardless of the number of shares you own, you are an owner of Campbell Soup Company, an iconic American brand that has floundered under the current Board’s leadership. It is up to you to vote for change. The Board will reach out to you with claims that this time will be different and a promise that they can set the Company on a better path. We do not believe leopards change their spots and so we ask you to support our proposed Independent Slate for Board nominees and vote the White Card to achieve the results you and all shareholders deserve.

Sincerely,

Third Point LLC

***

Your Vote Is Important, No Matter How Many or How Few Shares You Own!

PLEASE REMEMBER TO CAN THE COMPANY’S CARD! If you return a Campbell’s proxy card – even by simply indicating “withhold” on the Company’s slate – you will revoke any vote you had previously submitted for Third Point on the WHITE proxy card.

IMPORTANT INFORMATION

On September 28, 2018, Third Point LLC filed a definitive proxy statement (the “Definitive Proxy Statement”) with the U.S. Securities and Exchange Commission (“SEC”) to solicit proxies from stockholders of Campbell Soup Company (the “Company”) for use at the Company’s 2018 annual meeting of stockholders. THIRD POINT STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE DEFINITIVE PROXY STATEMENT BECAUSE IT CONTAINS IMPORTANT INFORMATION. THE DEFINITIVE PROXY STATEMENT ALSO INCLUDES INFORMATION ABOUT THE IDENTITY OF THE PARTICIPANTS IN THE THIRD POINT SOLICITATION AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS THEREIN. The Definitive Proxy Statement is available at no charge on the SEC’s website at http://www.sec.gov and is also available, without charge, on request from Third Point LLC’s proxy solicitor, Okapi Partners LLC, at (855) 208-8902 or via email at [email protected].

View source version on businesswire.com: https://www.businesswire.com/news/home/20181001005539/en/

Press:

Third Point LLC

Elissa Doyle, 917-748-8533

Chief

Marketing Officer

[email protected]